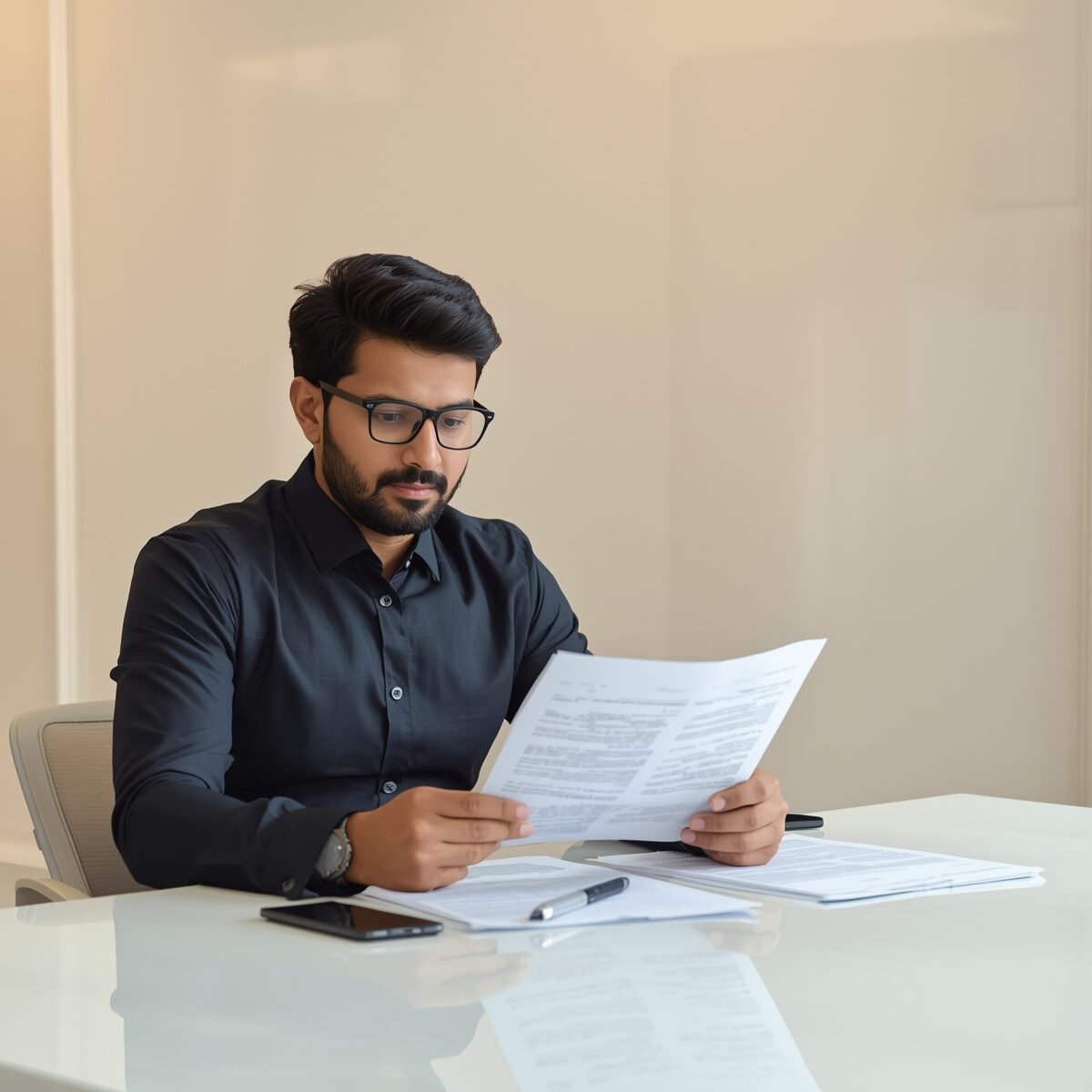

GST Registration

Get your business registered under Goods & Services Tax (GST) with ease. We handle the complete process from documentation to final registration.

When GST Registration is Compulsory

GST registration is mandatory for businesses exceeding the prescribed turnover limit or engaged in the interstate supply of goods and services.

It helps your business become tax compliant, enhances credibility, and allows you to claim input tax credit on purchases.

Timely registration also helps avoid penalties and legal issues.

Manufacturers

Businesses engaged in manufacturing goods with turnover exceeding ₹40 lakh (₹20 lakh in special category states).

Traders

Wholesalers, retailers, or distributors with annual turnover above ₹40 lakh (₹20 lakh in special category states).

Service Providers

Professionals or firms providing services with turnover exceeding ₹20 lakh (₹10 lakh in special category states).

E-commerce Sellers

All sellers on platforms like Amazon, Flipkart, or own website, irrespective of turnover.

Inter-state Suppliers

Businesses supplying goods/services across state borders, mandatory regardless of turnover threshold.

When GST Registration is Optional

Businesses below the turnover threshold can register voluntarily.

Voluntary registration is beneficial because

- You can claim Input Tax Credit (ITC) on purchases.

- Enhances business credibility with clients and suppliers.

Documents Required for GST Registration

For Proprietorship

- PAN card of the proprietor

- Aadhaar card of the proprietor

- Photograph of the proprietor

- Proof of business address (electricity bill, rent agreement, or property tax receipt)

- Bank account proof (cancelled cheque/bank statement)

For Company

- PAN card of the company

- Certificate of Incorporation (COI)

- Memorandum & Articles of Association

- PAN & Aadhaar of directors

- Board resolution for GST registration authorization

- Business address proof

- Bank account proof

For Partnership Firm / LLP

- PAN card of firm/LLP

- Partnership deed / LLP agreement

- PAN & Aadhaar of partners

- Proof of business address

- Bank details

Process of GST Registration

We assess your business type, turnover, and applicability.

You share the necessary KYC and business documents.

We fill and verify the GST REG-01 form on the GST portal.

The application is submitted along with digital signature (DSC) where required.

You receive an Application Reference Number (ARN) for tracking.

The GST officer reviews the application.

Upon approval, your GSTIN (GST Identification Number) and registration certificate are issued.

Our Services Include

Eligibility assessment

We evaluate your business structure and turnover to determine whether GST registration is mandatory or beneficial for you.

Preparation & submission of application

Our team handles the complete process of preparing and submitting your GST registration application through the GST portal.

Document verification & error-free filing

We ensure all required documents are accurate and complete to avoid delays or rejections during the registration process.

Assistance in obtaining GSTIN

From tracking your application status to coordinating with authorities, we assist you until your GSTIN is successfully issued.

Post-registration support (amendments, additional places, etc.)

We provide ongoing assistance with amendments, adding additional business locations, and updating details as your business grows